BSE, LOB, Derivatives, and Betting

Cards

Q: What is bid-offer spread? A: The difference between the highest bid and lowest offer

Q: What is the mid-price? A: The midpoint between the highest bid and lowest offer

Q: What is the micro-price? A:

Q: What is a future? A: A contract that will be executed by/at a set time. Specifies a forward price that the trade will execute at. Buyer is in a long position, seller is in a short position.

Q: What is an option? A: A contract that may be executed by/at a set time. Confer a right but not an obligation to carry out a trade.

Q: What is the price an option specifies called? A: Strike/exercise price

Q: What is the difference between a put and a call? A: A put is an option to sell, a call is an option to buy. An option is written/issued by the seller and held/exercised by the buyer.

Q: What does standardised mean in the context of a derivative? A: Size of the contract and its delivery date are pre-specified.

Q: What is the difference between American and European style options? A: American-style options mean the exercise can happen at any time up to the expiry. European-style mean the exercise only happens at the expiry.

Q: How is an option price determined? A: - Intrinsic value - money received if the option is exercised now

- Volatility premium - dependent on underlying’s price volatility

- Time Value - potential risk-free return on money saved wrt buying underlying

Q: What conditions can a call be in? A: Lets the holder buy at a set price.

- In-the-money if underlying price higher than strike price

- Out-of-the-money (underwater) if underlying price is less than strike

- At-the-money if underlying price is equal to the strike

Q: What conditions can a put be in? A: Lets the holder sell at a set price.

- In-the-money if underlying price lower than strike price

- Out-of-the-money (underwater) if underlying price is higher than strike

- At-the-money if underlying price is equal to the strike

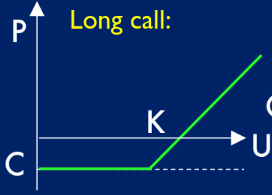

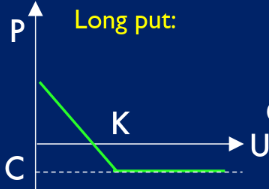

Q: What does a payoff diagram look like?

A:  Where U is the price of the underlying, C is the cost of the option, and K is the strike price.

Where U is the price of the underlying, C is the cost of the option, and K is the strike price.

Q: What is a bull spread? A: Combining a long and a short such that you believe a price will be in an interval between the two strike prices or better.

Q: What is a bear spread? A: Combining a short and a long such that you believe a price will be in an interval between the two strike prices or worse.

Q: What does a long call payoff look like?

A:

Q: What does a short call payoff look like?

A:

Q: What does a long put payoff look like?

A:

Q: What does a short put payoff look like?

A:

Q: What does a short butterfly look like?

A:  Means you will make money if the price stays within the range. Long butterfly means you make money if it goes out of the range.

Means you will make money if the price stays within the range. Long butterfly means you make money if it goes out of the range.

Q: What is a short straddle?

A:  You sell a call and a put, such that if the options expire with the current price at the strike price they are worthless, leaving you with the fee you charged the buyer.

You sell a call and a put, such that if the options expire with the current price at the strike price they are worthless, leaving you with the fee you charged the buyer.

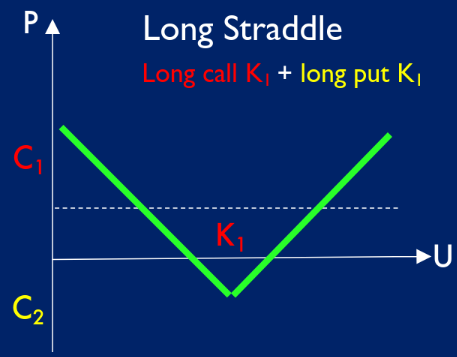

Q: What is a long straddle?

A: You buy a call and a put, such that when the options expire the price has significantly moved from the strike price.

You buy a call and a put, such that when the options expire the price has significantly moved from the strike price.

Q: What is the difference between a straddle and a strangle? A: A strangle has two different strike prices, and tends to be cheaper to purchase.

Q: What is the difference between being long and short? A: In a long, you paid someone else to receive an option. In a short, someone else paid you for an option.

Q: What is the difference between a call and a put? A: A call is an agreement to buy from the issuer. A put is an agreement to sell to the issuer.